Powered by Lemma Series

How Khasma Capital Uses Agentic Retrieval to Unlock the "Impossible", 96% Faster

Jen Hilibrand - VP, Applied AI and Strategy at Thread AI

Bryant Lewis - Operations Strategist at Thread AI

Josh Kaufman - Founder and Managing Partner at Khasma Capital

January 23, 2026

In the latest installment of our Powered by Lemma series, we explore how Khasma Capital is using AI to modernize the diligence stack for climate infrastructure investing.

Scaling Manual,

Complex Investment Diligence

Agentic Retrieval

96%

Reduction in Time for Complex Queries

Unlocking Previously Impossible Analysis

The transition to a net-zero economy represents a significant capital reallocation, yet a critical inefficiency remains. Khasma Capital operates in the 'Missing Middle' of the energy transition, which represents the financing gap between early-stage venture capital and mature infrastructure finance.

This "Valley of Death" exists not just because of capital scarcity, but because of complexity. The climate sector is fragmented across a wide variety of technologies and end markets, ranging from hydrogen electrolysis to battery recycling. Each niche requires specialized knowledge, making traditional investor diligence tedious, impractical, and slow.

Khasma's mandate is unique: it aims to bridge this gap by investing growth capital into companies commercializing and scaling energy transition technologies. Through diligent research and decades of expertise, they invest in, advise, and scale market leaders in specially-picked, fast-growing sectors. However, executing this mandate requires validating complex physical realities on compressed timelines.

The Challenge

Data Density & Scaling Institutional Memory

Khasma sees a significant volume of deal flow at approximately 100 deals per quarter. Each opportunity arrives with a data room containing dozens of documents, ranging from technical patents to complex financial models.

The challenge wasn't just processing new data; it was accessing old data. Over years of operation, Khasma has accumulated a wealth of resources, scattered across hundreds of deals and separated into thousands of Excel files, word documents, and PDFs. This institutional memory is one of the firm's greatest assets but accessing and processing it was difficult. It had grown to a level that any individual's pattern recognition based on memory was increasingly suboptimal. The team needed a more effective way for all team members to view and synthesize the data.

Furthermore, in high-stakes infrastructure, generic AI "hallucinations" are unacceptable. Precision regarding chemical constraints, engineering and technology processes, construction requirements, or regulatory deadlines is non-negotiable. The industry requires systems that prioritize verifiable accuracy over creative generation.

The Solution

Agentic Retrieval & Automated Synthesis

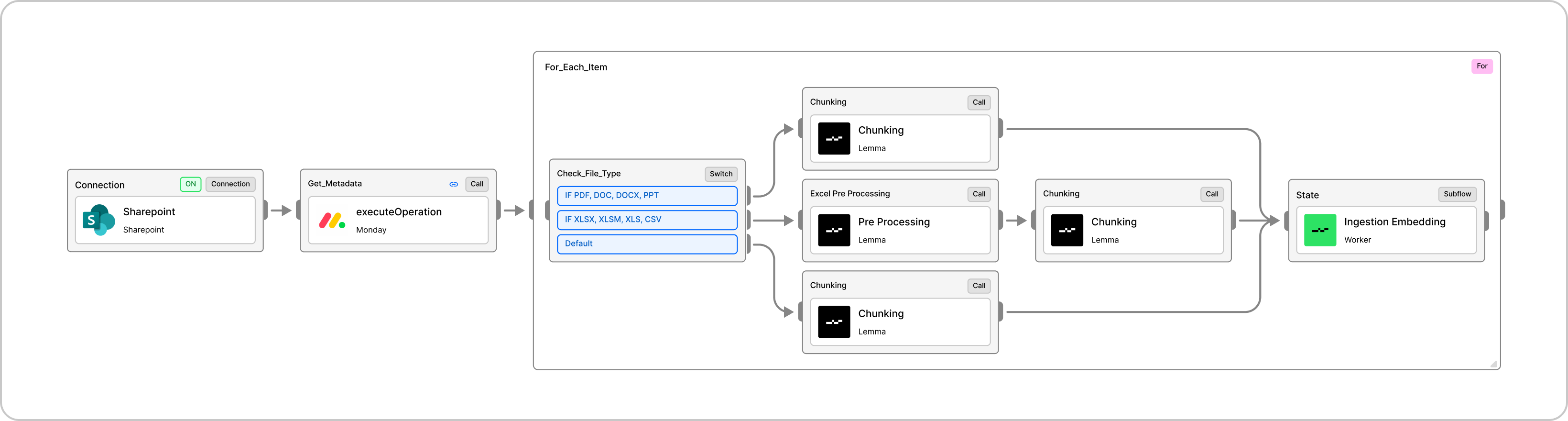

To address these challenges, Khasma Capital and Thread AI partnered to engineer a secure Data Orchestration Layer built on Thread AI's Lemma platform.

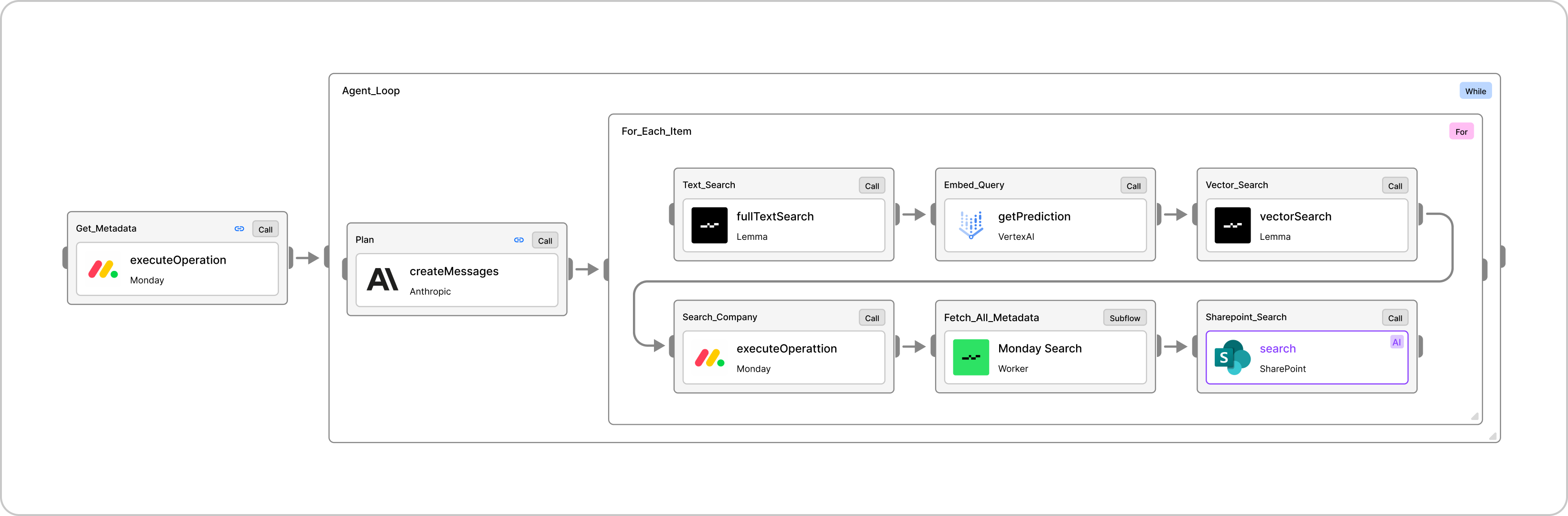

Rather than treating the problem as simple storage, this architecture focuses on Agentic Retrieval, which includes deploying AI agents to actively fetch, parse, and synthesize information from across Khasma Capital's vast repository. It transforms static documents into a dynamic ecosystem where data is always accessible for immediate action.

Our shared philosophical approach prioritized three technical pillars:

1

Low-Latency Agentic Search

The system does not just look up keywords; it acts as an agent that can actively query cross-company metrics and benchmark historical performance in real-time.

2

Traceable Citations

We implemented a rigorous RAG (Retrieval Augmented Generation) framework that forces the model to cite its sources. Every insight generated links directly back to the specific page in the data room, creating the audit trail required for high-conviction decision-making.

3

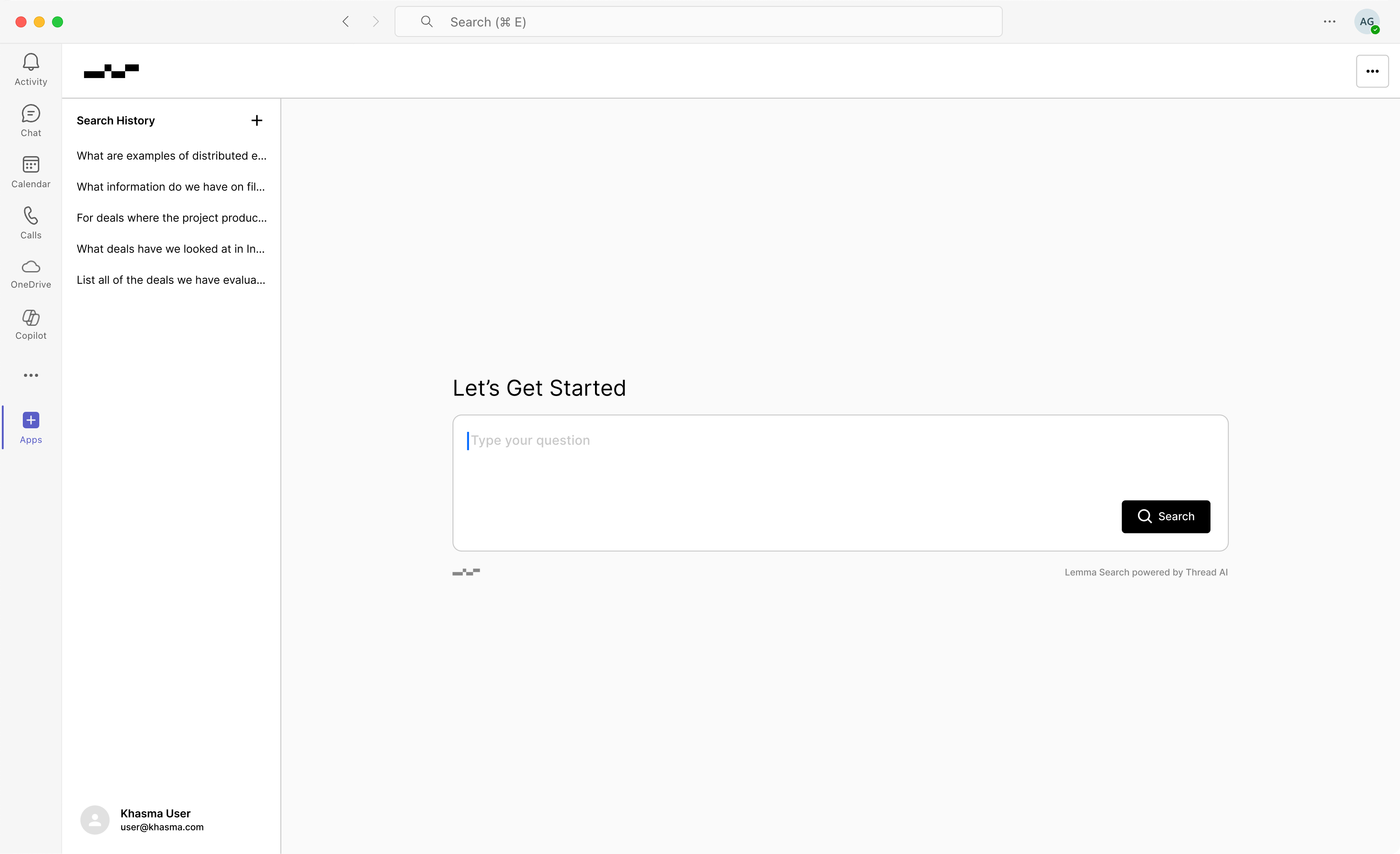

Maximizing Adoption by Embedding Into the Existing Toolchain

To ensure adoption, we embedded Lemma Workers directly into Khasma's existing Microsoft toolchain. This integrates powerful retrieval capabilities into natural workflow patterns, rather than forcing users onto a new platform.

The Impact

Two Levels of Transformation

By deploying this Lemma-powered workflow, Khasma Capital has unlocked two distinct levels of operational value:

Unlocking previously impossible insights while reducing complex query time by up to 96%.

1

Accelerating the Known (Diligence Efficiency)

First, the system dramatically accelerates existing workflows. Routine but high-friction tasks, such as cross-referencing a unit economics model against five similar past projects, can now be executed in moments rather than days. This frees up the investment team to focus on strategic analysis rather than data aggregation.

2

Unlocking the Unknown (Feasibility)

Second, and perhaps more transformative, the tool makes previously impossible analyses viable. In the past, granular analyses such as comparing biomass conversion ratios across dozens of biochar deals, categorizing which technologies are more likely to have offtake agreements, or reviewing the composition of a management team, were effectively "lost" if they hadn't been manually tagged in a structured database.

To retrieve that data traditionally would require weeks of manual review, meaning such deep-dive comparative analysis wouldn't have been possible.

Now, the system can mine, calculate, and aggregate those specific metrics across the entire unstructured portfolio in less than a minute.

While the output is still manually sense-checked, this capability allows the team to validate assumptions against the firm's total experience, rather than just what is easily accessible.

Beyond Search

Knowledge as Action

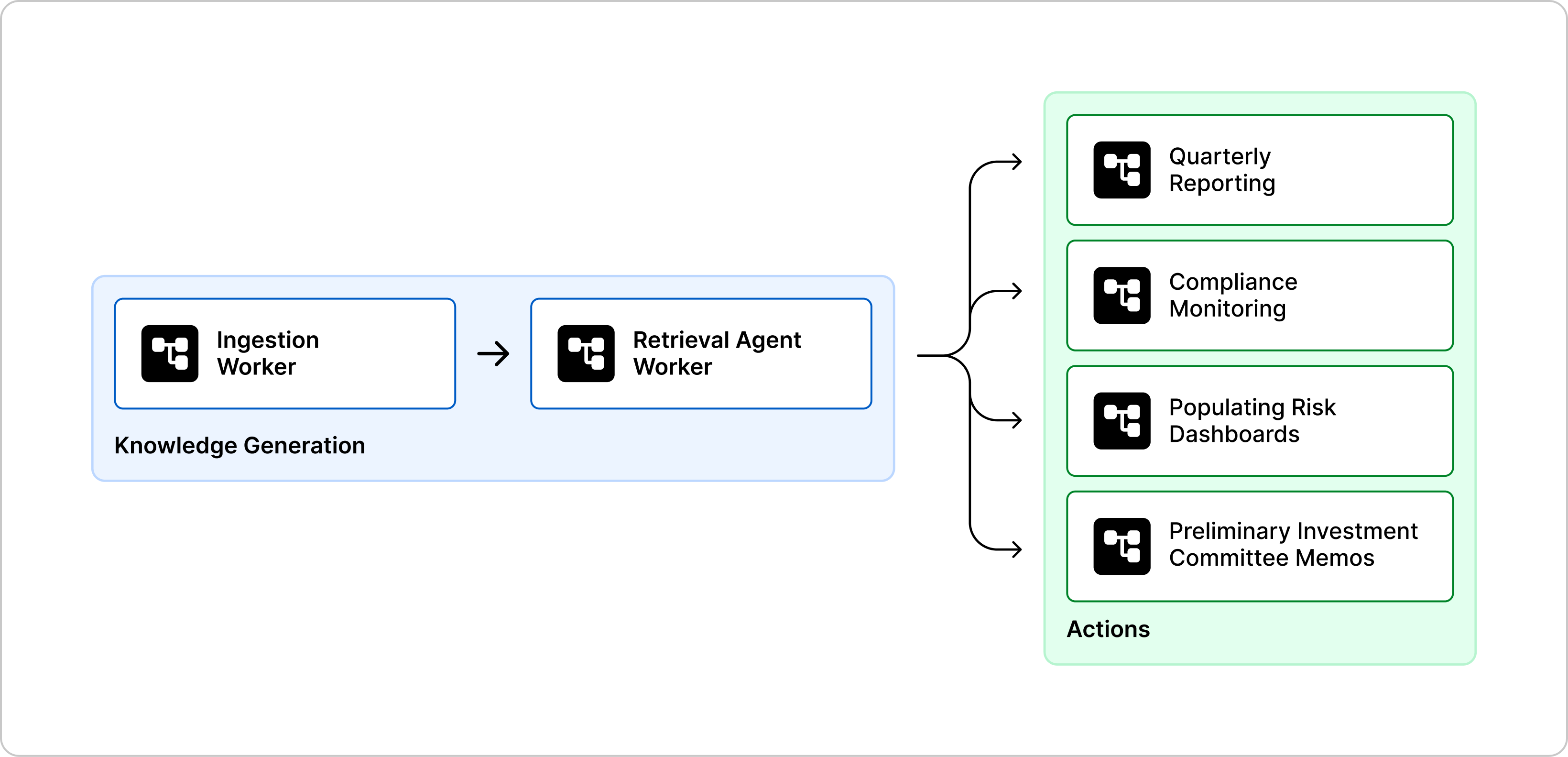

This deployment highlights a critical insight for the future of financial operations: the most powerful applications of workflow automation occur when knowledge management is an embedded step, not the entire process.

With Lemma, the retrieval of information and generation of content can serve as the initial phase of a larger orchestration that transforms raw data into a final deliverable. We are moving toward a model where the system not only retrieves information but actively orchestrates it into tangible business value (e.g. automatically feeding real-time analytics, synchronizing systems of record, and synthesizing complex strategic deliverables). In the broader financial services landscape, this approach unlocks the potential to automate complex, multi-stage workflows, such as quarterly reporting, compliance monitoring, risk analyses, and investment memos, where the synthesis of data is merely the first step for downstream action.

Looking Ahead

For Thread AI, this deployment demonstrates the flexibility of Lemma to serve as invisible, critical infrastructure in highly regulated, technical industries. For Khasma, this is about turning a large magnitude of disparate, unstructured technical data into clear, defensible conviction. By deploying agentic AI to augment and accelerate human capability, Khasma is equipped to harness the data deluge for comprehensive investment insight, ensuring the most promising climate infrastructure projects get built.

Start building your diligence context engine and gain immediate value by leveraging Thread AI's pre-built critical patterns.

Contact our team to learn more.